Electric Vehicle Tax Credit Phase Out 2022 . the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. prior to the inflation reduction act, a new vehicle purchased and delivered by december 31, 2022, could qualify for a. the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. How does the inflation reduction act modify the existing tax credit for new electric vehicles? tucked inside the massive inflation reduction act of 2022 that was signed into law in august is a complex set of requirements around which evs and other clean vehicles do and do not qualify for a. to assist consumers identifying eligible vehicles, the department of transportation and department of.

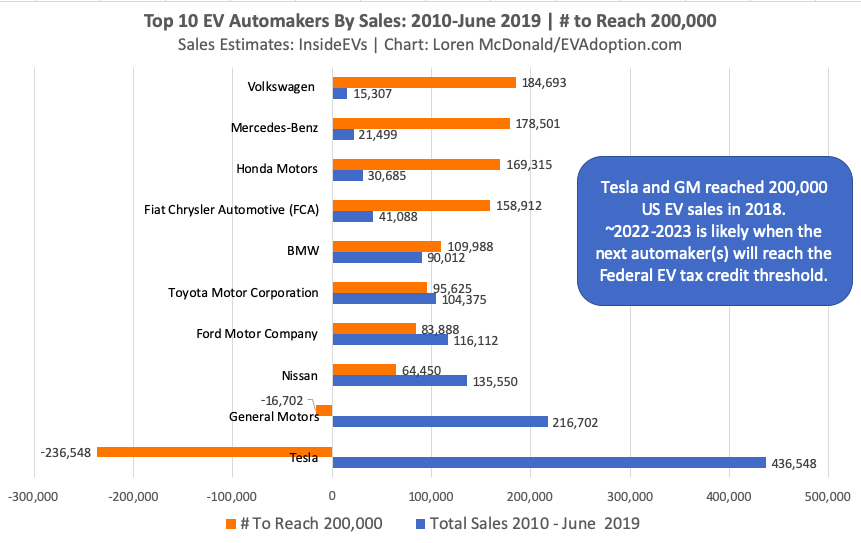

from evadoption.com

prior to the inflation reduction act, a new vehicle purchased and delivered by december 31, 2022, could qualify for a. How does the inflation reduction act modify the existing tax credit for new electric vehicles? to assist consumers identifying eligible vehicles, the department of transportation and department of. the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. tucked inside the massive inflation reduction act of 2022 that was signed into law in august is a complex set of requirements around which evs and other clean vehicles do and do not qualify for a. the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the.

Federal EV Tax Credit Phase Out Tracker By Automaker EVAdoption

Electric Vehicle Tax Credit Phase Out 2022 prior to the inflation reduction act, a new vehicle purchased and delivered by december 31, 2022, could qualify for a. prior to the inflation reduction act, a new vehicle purchased and delivered by december 31, 2022, could qualify for a. the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. tucked inside the massive inflation reduction act of 2022 that was signed into law in august is a complex set of requirements around which evs and other clean vehicles do and do not qualify for a. the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. to assist consumers identifying eligible vehicles, the department of transportation and department of. How does the inflation reduction act modify the existing tax credit for new electric vehicles?

From futurefluxtech.com

How to Qualify for the Full 7,500 Federal Electric Vehicle Tax Credit Electric Vehicle Tax Credit Phase Out 2022 the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. tucked inside the massive inflation reduction act of 2022 that was signed into law in august is a complex set of requirements around which evs and other clean vehicles do and do not qualify for a. prior. Electric Vehicle Tax Credit Phase Out 2022.

From mechanicjjanggle.z14.web.core.windows.net

Do Hybrid Cars Qualify For A Tax Credit 2022 Electric Vehicle Tax Credit Phase Out 2022 prior to the inflation reduction act, a new vehicle purchased and delivered by december 31, 2022, could qualify for a. to assist consumers identifying eligible vehicles, the department of transportation and department of. the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. How does the inflation. Electric Vehicle Tax Credit Phase Out 2022.

From mechanicjjanggle.z14.web.core.windows.net

Plug In Hybrid Eligible For Tax Credit Electric Vehicle Tax Credit Phase Out 2022 to assist consumers identifying eligible vehicles, the department of transportation and department of. the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. How does the inflation reduction act modify the existing tax credit for new electric vehicles? tucked inside the massive inflation reduction act of 2022. Electric Vehicle Tax Credit Phase Out 2022.

From evadoption.com

Federal EV Tax Credit Phase Out Tracker By Automaker EVAdoption Electric Vehicle Tax Credit Phase Out 2022 prior to the inflation reduction act, a new vehicle purchased and delivered by december 31, 2022, could qualify for a. the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. tucked inside the massive inflation reduction act of 2022 that was signed into law in august is. Electric Vehicle Tax Credit Phase Out 2022.

From www.slideteam.net

Electric Vehicle Tax Credit Phase Out In Powerpoint And Google Slides Cpb Electric Vehicle Tax Credit Phase Out 2022 tucked inside the massive inflation reduction act of 2022 that was signed into law in august is a complex set of requirements around which evs and other clean vehicles do and do not qualify for a. the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. to. Electric Vehicle Tax Credit Phase Out 2022.

From evadoption.com

Impact of Proposed Changes to the Federal EV Tax Credit Part 1 Electric Vehicle Tax Credit Phase Out 2022 How does the inflation reduction act modify the existing tax credit for new electric vehicles? the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. tucked inside. Electric Vehicle Tax Credit Phase Out 2022.

From www.emobilitysimplified.com

How does US Federal Tax Credit for Electric Vehicles work? Update on Electric Vehicle Tax Credit Phase Out 2022 the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. to assist consumers identifying eligible vehicles, the department of transportation and department of. prior to the. Electric Vehicle Tax Credit Phase Out 2022.

From newandroidcollections.blogspot.com

Electric Vehicle Tax Credit Amount Electric Vehicle Tax Credits What Electric Vehicle Tax Credit Phase Out 2022 to assist consumers identifying eligible vehicles, the department of transportation and department of. the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. tucked inside the. Electric Vehicle Tax Credit Phase Out 2022.

From orangeandbluepress.com

7,500 Electric Vehicle Tax Credit Updates for 2023 Orange and Blue Press Electric Vehicle Tax Credit Phase Out 2022 tucked inside the massive inflation reduction act of 2022 that was signed into law in august is a complex set of requirements around which evs and other clean vehicles do and do not qualify for a. prior to the inflation reduction act, a new vehicle purchased and delivered by december 31, 2022, could qualify for a. the. Electric Vehicle Tax Credit Phase Out 2022.

From mypoisonedapple.blogspot.com

Electric Vehicle Tax Credit 2023 Electric Vehicle Tax Credit Survives Electric Vehicle Tax Credit Phase Out 2022 the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. prior to the inflation reduction act, a new vehicle purchased and delivered by december 31, 2022, could. Electric Vehicle Tax Credit Phase Out 2022.

From mechanicjjanggle.z14.web.core.windows.net

Is There A Tax Credit For Hybrid Cars In 2022 Electric Vehicle Tax Credit Phase Out 2022 to assist consumers identifying eligible vehicles, the department of transportation and department of. tucked inside the massive inflation reduction act of 2022 that was signed into law in august is a complex set of requirements around which evs and other clean vehicles do and do not qualify for a. prior to the inflation reduction act, a new. Electric Vehicle Tax Credit Phase Out 2022.

From usnewsper.com

Electric Vehicle Tax Credits What You Need to Know US Newsper Electric Vehicle Tax Credit Phase Out 2022 tucked inside the massive inflation reduction act of 2022 that was signed into law in august is a complex set of requirements around which evs and other clean vehicles do and do not qualify for a. the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. to. Electric Vehicle Tax Credit Phase Out 2022.

From evadoption.com

Federal EV Tax Credit Phase Out Tracker By Automaker EVAdoption Electric Vehicle Tax Credit Phase Out 2022 the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. tucked inside the massive inflation reduction act of 2022 that was signed into law in august is a complex set of requirements around which evs and other clean vehicles do and do not qualify for a. to. Electric Vehicle Tax Credit Phase Out 2022.

From 1800accountant.com

Electric Vehicle Tax Credit Explained 1800Accountant Electric Vehicle Tax Credit Phase Out 2022 How does the inflation reduction act modify the existing tax credit for new electric vehicles? tucked inside the massive inflation reduction act of 2022 that was signed into law in august is a complex set of requirements around which evs and other clean vehicles do and do not qualify for a. to assist consumers identifying eligible vehicles, the. Electric Vehicle Tax Credit Phase Out 2022.

From www.hartenergy.com

Will Electric Vehicle Demand Drop After Tax Credits Expire? Hart Energy Electric Vehicle Tax Credit Phase Out 2022 tucked inside the massive inflation reduction act of 2022 that was signed into law in august is a complex set of requirements around which evs and other clean vehicles do and do not qualify for a. the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. prior. Electric Vehicle Tax Credit Phase Out 2022.

From evadoption.com

Federal EV Tax Credit Phase Out Tracker By Automaker EVAdoption Electric Vehicle Tax Credit Phase Out 2022 to assist consumers identifying eligible vehicles, the department of transportation and department of. How does the inflation reduction act modify the existing tax credit for new electric vehicles? the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. the inflation reduction act of 2022 (ira) makes several. Electric Vehicle Tax Credit Phase Out 2022.

From dxojuxfzv.blob.core.windows.net

Which Electric Cars Qualify For Tax Credit In 2022 at Sandra Williams blog Electric Vehicle Tax Credit Phase Out 2022 prior to the inflation reduction act, a new vehicle purchased and delivered by december 31, 2022, could qualify for a. the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. to assist consumers identifying eligible vehicles, the department of transportation and department of. How does the inflation. Electric Vehicle Tax Credit Phase Out 2022.

From elektronikdesigara.com

EV Tax Credits and Rebates List 2022 Guide (2022) Electric Vehicle Tax Credit Phase Out 2022 the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. the inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the. prior to the inflation reduction act, a new vehicle purchased and delivered by december 31, 2022, could. Electric Vehicle Tax Credit Phase Out 2022.